Form GST RFD-11

Categories

GST Services

How to furnish LUT in RFD-11 on GST Portal?

All the tax payers who are registered and export the services or goods also require to furnish LUT (Letter of Undertaking) on RFD-11 form of the GST on the website of GSTN to exports goods or service without any need of making the IGST payment.

When to file/apply LUT in RFD-11?

Before exporting the services or the goods, the LUT (letter of undertaking) need to be submitted or filed online. Before this the exporters require to submit manually the signed and filled RFD-11 on the letterhead of the business in duplicate.

The assistant commissioner or the deputy jurisdictional have to jurisdiction on their important business place where the export documents verification performed via icegate medium. Other along with the documents of export to the authority of the customs clearance.

Similar to the previous regime of excise, this will result into wastage of operating expenses and important time of the exporters. This procedure is quick, simple and made rationalized. It provides liquidity in the whole exports procedure by the exporter to the entire involved contributors.

Remember that bond furnishing has to be performed on a stamp paper non-judicial and therefore requires submission manually.

Provide new Letter of undertaking for Financial Year 2019-20

For a financial year, the letter of undertaking is valid. If the letter of undertaking was provided in financial year 2018-19, then the expiry date of the letter of undertaking validity is March 31st, 2019. This means for the financial year 2019-20, you need to provide new letter of undertaking.

To furnish letter of undertaking, the following steps needs to be performed on GSTN of the GST website.

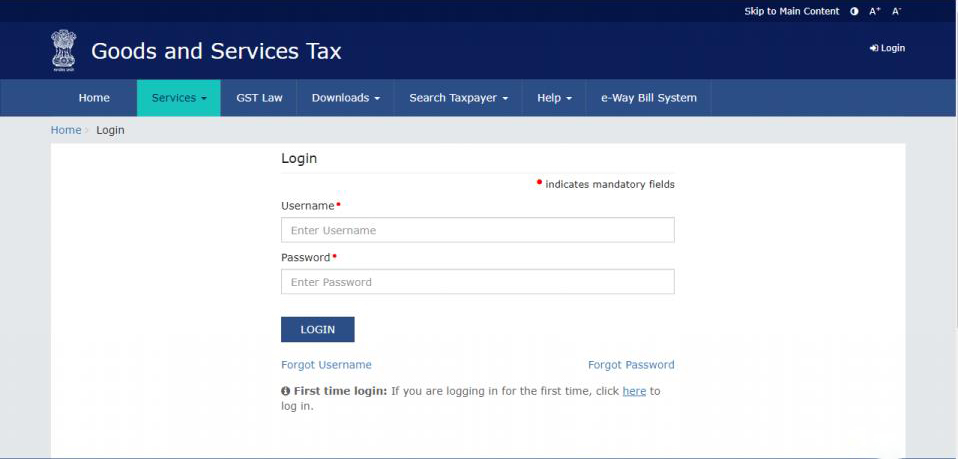

Step 1 - The first step is to login to the website of the GST i.e. https://services.gst.gov.in/services/login

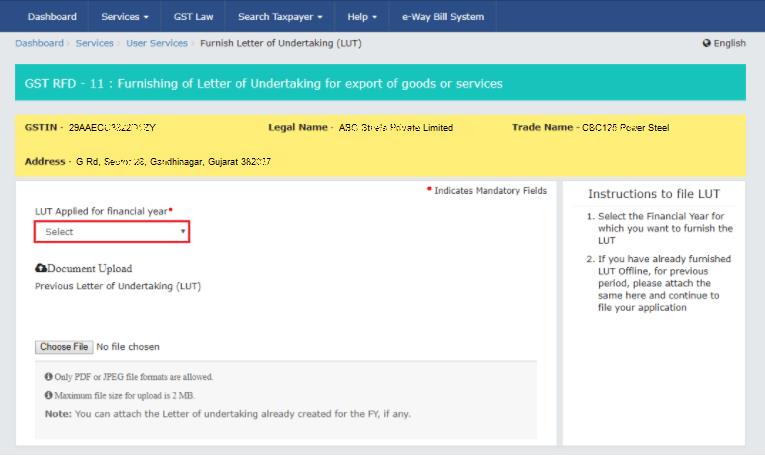

Step 2 - The second step is to visit the tab “Services” then goes to ‘user services’ and choose ‘LUT “letter of undertaking’.

Step 3 - The third step is to choose the financial year for which the LUT is enforced from the drop-down list of ‘LUT applied for financial year’.

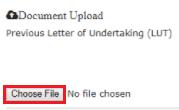

Important: if LUT is manually furnished for the prior intervals, then you require to upload the LUT by clicking on the option ‘Choose File’ on the similar window. Make sure that you can upload files up to 2MB in size. Also, the JPEG or the PDF formats of files are permitted.

Important: if LUT is manually furnished for the prior intervals, then you require to upload the LUT by clicking on the option ‘Choose File’ on the similar window. Make sure that you can upload files up to 2MB in size. Also, the JPEG or the PDF formats of files are permitted.

Step 4 - The fourth step is to input the essential information in the LUT/GST RFD-11 which displays on the computer screen. You require to perform following things on this form.

You need to self-declare by clicking on given three boxes. By performing this, the exports understood that

- Services or goods export will be finished within a three months interval from the issue date of invoice export or more interval if any permitted by the commissioner.

- Follow the law of the GST relating to the exports.

- To pay IGST and interest, if do not able to export.

The interest need to be paid at a rate of 18% p.a. for the interval from issue date of invoice export till IGST payment date.

Provide independent information of witnesses: you require to give the address, occupation and name of the two witnesses who are independent in the highlighted red color boxes compulsorily.

Also remember that witnesses announced in the LUT are those which are also announced on the bank guarantee or the running bond.

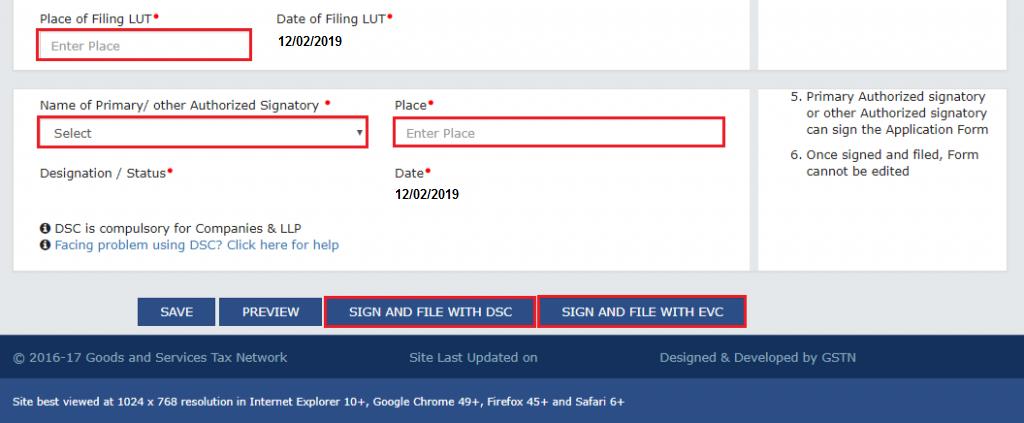

Step 5 - The fifth step is to input the filing place, then you need to click at ‘Save’ and to confirm the accuracy of the form before its submission you require to click at “Preview’.

Remember that it is possible to revise a submitted or the signed form.

Step 6 - The sixth step is to file and sign the form deploying the options given below:

Any other authorized signatory or the primary authorized signatory can sign the LUT (Letter of Undertaking). The authorized signatory will be a person, a proprietor, company secretary, or the managing director fully authorized by the board of directors or the working partner of the proprietor or company for form execution. By using the digital signature certificate, you require to sign the application of the chosen authorized signatory. To deploy this alternative, you require to click at “Sign and file with DSC’. After that a warning message displays. Then you require to click at “Proceed”. The system creates a distinct Application reference number (ARN). To use the alternative “submit with EVC’, the authorized signatory required to click at ‘Sign and file with EVC’. An OTP is send by the system to the registered mobile number and email Id of the authorized signatory. Input the OTP for signing application. A warning message displays. You need to click at “Proceed’. The system makes a distinct Application reference number (ARN). The LLPS and the companies need to use the digital signature certificate for filing purpose. A message of confirmation displays on the screen. The website of the GST sends the application reference number to the registered mobile and email id of the taxpayer by the SMS and the email. To download the acknowledgement, you require to click on the button “Download”. You can also identify the LUT (letter of undertaking) furnished previously on the website of the GST. On the website home page, you can visit ‘Services’ then go to ‘User services’. After that click on ‘View my LUTs submitted’. And click at ‘Select period’. You can easily find out the LUTs list provided during the interval selected. The final step is to click on ‘View’ to see the full information of the specific LUT (Letter of Undertaking).

What Clients Say

Prakash Verma

Praveen Chauhan

Pradeep Kochhar

Blogs

In today's dynamic business landscape, navigating through various regulatory requirements and financial obligations can be... Read More

FinacBooks is a reliable platform that helps business owners in getting verified leads. It offers various services and solutions that can... Read More

Starting a new business in India requires several legal procedures, paperwork, and timely compliance with regulatory authorities. Company... Read More