Cancel GST Registration

Categories

GST Services

How to Cancel GST Registration?

When it comes to the cancellation of GST registration, you can either choose to cancel the same either by registered person or by a GST officer. Cancellation of GST registration is convered in the Section 29(1) of CGST Act 2017.

Voluntary Cancellation of GST registration by registered person

In order to cancel your GST registration, you have to give the suitable reason for doing so and the probable reasons for the same could be one of the below:

However, despite having a valid reason, you cannot opt for the GST registration cancellation before 1 year from the date of registration.

Cancellation of GST registration by a GST officer

In case GST Officer finds faults in your GST registration then he is entitled to cancel the same however he will consider your case on the below mentioned grounds:

Once your registration is cancelled by the GST officer, you can revoke the same if you act in time by filing Form GST REG 21 within 30 days of service of cancellation of order. However, before you start with the revocation process, you need to make sure that all defaults have been cleared based on which your registration was cancelled by the GST Officer. In case the GST Officer finds your application valid and if there is no pending defaults, then he will revoke the cancellation using Form GST REG 22.

If you want to cancel the GST registration voluntarily, then you need to fill up an application Form GST REG-16 within 30 days of the event based on which you are cancelling the registration, however at times it is not possible to specify the exact date of the event then you can interpret the deadline or date in a liberal manner. While filling up the form GST REG-16, it is mandatory to include below mentioned information, such as:

- Ground of cancellation.

- The desired date of cancellation.

- Contact address including mobile number and email address.

- Particulars of the value and the tax payable on the stock of inputs, the inputs available in semi-finished goods, inputs available in finished goods, the stock of capital goods/plant and machinery.

- Particulars of the registration of the entity such as when was it merged, transferred or amalgamated.

- Particulars of the latest return filed by the taxpayer along with the ARN of the particular return.

GST Registration Cancellation Forms

There are various forms available on the GSTIN portal which you might need during the GST registration cancellation process such as:

Form GST REG 16 - This form is used if the GST registration is cancelled voluntarily by the registered person.

Form GST REG 17 - This form is used if the GST officer has found any default in your GST registration and to issue show cause notice.

Form GST REG 18 - This form is used by the registered person to reply to the show cause notice by registered person.

Form GST REG 19 - GST Officer used this form to pass order for the cancellation of GST order cancellation.

Form GST REG 20 - You as a registered person can use this form to stop the GST registration cancelled based on the reply you have given to the show cause notice by Form GST REG 18.

Form GST REG 21 - This form is used by the registered person to revoke the cancellation.

Form GST REG 22 - This form is used by the GST officer to pass the revocation order of cancelled GST registration.

Cancel GST Registration Online

To file for cancellation of GST registration, you have to follow below steps –

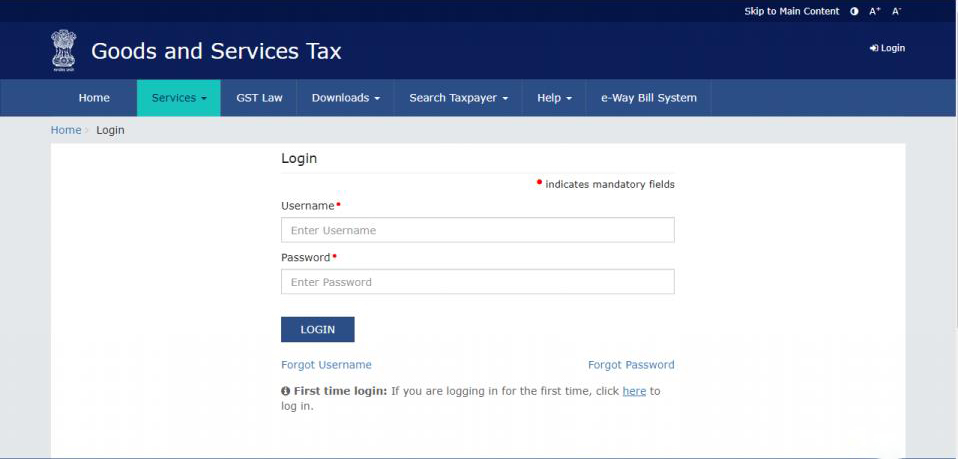

Step 1 - Login to GST Portal https://www.gst.gov.in with user-ID and password

Step 2 – Go to Services -> Registration -> Select “Application for Cancellation of Registration”

Step 3 - Application for Cancellation of Registration contains three tabs. Ensure that the Basic Details tab is selected by default.

Step 4 - Application for Cancellation of Registration contains three tabs. Ensure that the Basic Details tab is selected by default.

Step 5 - You can select Address same as above. If Address is differ then enter the address information. Click on “Save and Continue”

Step 6 – Select “Reason for Cancellation” from the drop down list, Date of Cancellation and then click “Save and Continue”.

Step 7 - You will see different entries in respect to selected reason for Cancellation. Fill the complete according as per select cancellation reason. Click “Save and Continue”.

Step 8 - Check the Verification statement box to declare that the information given in this form is true and correct, and that nothing has been concealed therefrom. Select the name of the authorised signatory from the Name of Authorized Signatory drop-down and Enter the Place of making this declaration.

Step 9 - Sign the form by using your Digital Signature Certificate (DSC) or the EVC option

Step 10 – You will receive OTP on your number and then Enter OTP.

Step 11 – When you “Validate OTP” and you will the confirmation for GST Registration Cancellation Submission.

What Clients Say

Prakash Verma

Praveen Chauhan

Pradeep Kochhar

Blogs

In today's dynamic business landscape, navigating through various regulatory requirements and financial obligations can be... Read More

FinacBooks is a reliable platform that helps business owners in getting verified leads. It offers various services and solutions that can... Read More

Starting a new business in India requires several legal procedures, paperwork, and timely compliance with regulatory authorities. Company... Read More